santa clara county property tax collector

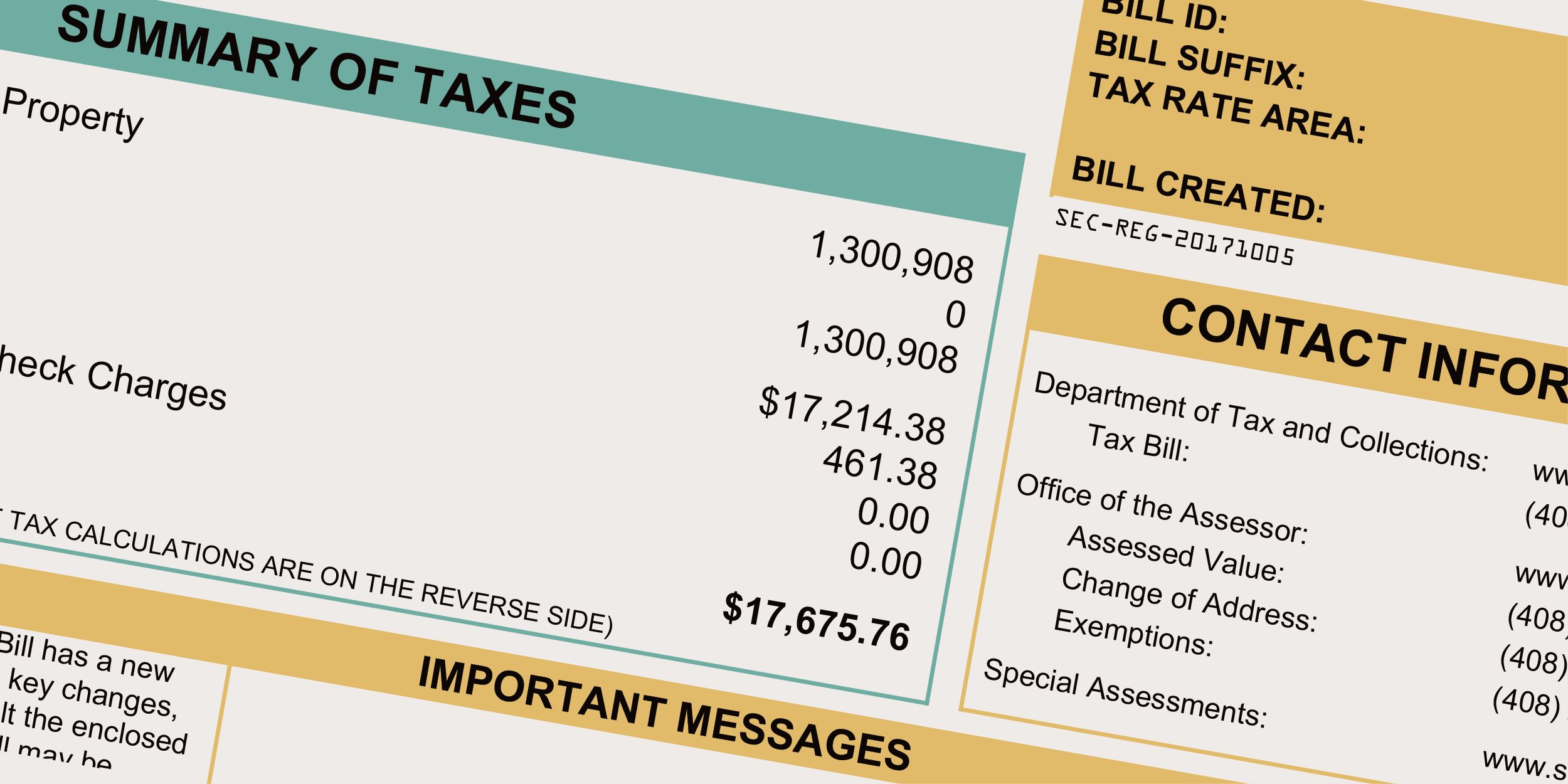

Tax Clearance Certificate Requirements Tax Clearance Letter obtained from the Office of the Tax Collector. Property tax is calculated by multiplying the propertys assessed value by all tax rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay.

Santa Clara County Property Tax Tax Assessor And Collector

The Santa Clara County Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in Santa Clara County.

. The tax rates are expressed as dollars per 100 of assessed value therefore the tax amount is already divided by 100 in order to obtain the correct value. It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt. Discover an overview of the property tax systems and should be helpful to new property taxpayers.

The Assessor is responsible for establishing assessed values used in calculating property taxes and maintaining ownership and address information. Currently you may research and print assessment information for individual parcels free of charge. Santa Clara County collects on average 067 of a propertys assessed fair market value as property tax.

Look up and pay your property taxes online. Frequently Asked Questions FAQs CA Code of Regulations Title 18 Chapter 1. Payments at the cashier window accepted until 5 pm.

PROPERTY ASSESSMENT INFORMATION SYSTEM. We are committed to meeting all legal requirements to our public business and government customers by collecting and distributing taxes license fees and information in a prompt and accurate manner while supporting a. 2022 County of Santa Clara.

On your tax bill you will see 1 Maximum Levy listed with the other individually identified charges for voter-approved debt. Enter Property Parcel Number APN. CA State Board of Equalization Publication 29 California Property Tax An Overview CA State Board of Equalization Publication 30.

12345678 123-45-678 123-45-678-00 Department of Tax and Collections. The Clerk of the Board of Supervisors furnishes a signed and sealed Certificate of Tax Clearance to requestors when sufficient security is submitted along with any other required documents as mandated by the State of California. CA State Tax Board of Equalization Property Tax Rules.

County of Santa Clara COVID-19 Vaccine Information for the Public. Monday Friday 800 am 400 pm. Closed on County Holidays.

Last Payment accepted at 445 pm Phone Hours. Three groupsCounty Assessor Controller-Treasurer and Tax Collectoradminister the Countys property taxes. Monday Friday 800 am 400 pm.

TAX COLLECTOR HOURS OF OPERATION. Read an overview of the administration of property taxes and the collection and distribution of taxes. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000.

Property Tax Distribution Charts. See how 1 assessed-value property taxes are distributed. 5359 State Route 30.

MondayFriday 800 am 500 pm. Find a range of public services and opportunities that enhance the quality of life. Enter Property Address this is not your billing address.

Walk-ins for assistance accepted until 4 pm. Property Tax Rate Book. The Office of the Treasurer Tax Collector is open from 8 am.

We are committed to serving all citizens of Santa Rosa County in the most courteous professional innovative and cost-effective manner. Saranac Lake NY 12983. Monday through Friday in room 140.

TELEPHONE AND EMAIL CUSTOMER SERVICE. Santa Clara County has one of the highest median property taxes in the United States and is ranked 38th of the 3143. Property Taxes View Pay Bills.

Skip to Main Content. MondayFriday 900 am400 pm. Proposition 13 the property tax limitation initiative was approved by California voters in 1978.

Property Tax Payment Options. See property tax rates and equalized assessed values. Learn about and apply for a Special.

The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County. Office of the Tax Collector. The Santa Clara County Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax.

Parcel Tax and Other Exemptions. SANTA CLARA COUNTY TAX COLLECTOR - 13 Photos 23 Reviews - Public Services Government - 70 W Hedding St San Jose CA - Phone Number - Yelp.

Santa Clara County Property Taxes Due Date Ke Andrews

Property Taxes Department Of Tax And Collections County Of Santa Clara

Longtime Santa Clara County Assessor Looks To Be The Winner Again San Jose Spotlight

Santa Clara Shannon Snyder Cpas

Property Tax Rate Book Controller Treasurer Department County Of Santa Clara

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

Santa Clara County Al Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

Santa Clara County Assessor Accuses Candidate Of Hacking Him

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Scam Alert County Of Santa Clara California Facebook

Appraiser Deputy Assessor Jobs Jobs Near Me

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara